Digital lending has become a cornerstone in modern banking. More than ever, customers expect smooth and easy-to-use borrowing solutions. Rising to meet this growing need is an increasing number of financial institutions offering digital lending products, from Buy Now Pay Later (BNPL) to mobile-focused personal and business loans. However, these solutions come with risks that threaten both lender and borrower. Digital lenders will not only need to be aware of these risks – they’ll also need to understand what they can do to safeguard against them, while remaining compliant and without compromising the quality of their product.

Digital lending’s accelerated growth

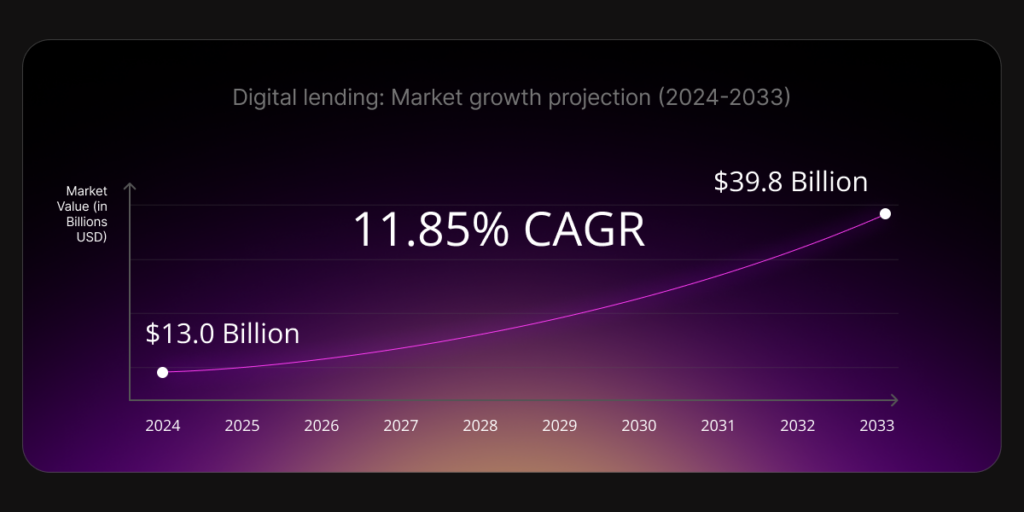

The digital lending market size reached a value of USD 13.0 Billion in 2024, and that’s anticipated to keep growing to USD 39.8 Billion by 2033. With an accelerated growth rate (CAGR) of 11.85%, there’s more variety in the type of financial institution offering digital borrowing solutions. While smaller and more nimble fintechs such as Klarna, Revolut and Silvr have become synonymous with digital lending in recent years, larger banks are getting involved too. Driven by the competition, advances in technology and a customer base that demands fast and seamless solutions, almost all large banks are now active in the online lending space.

However, while banks and financial institutions of all shapes and sizes race to achieve best-in-class borrowing solutions, they need to be aware of the dangers that come with digital lending so that they can protect themselves and their customers.

Challenges facing digital lenders

Credit risk

In order to provide best-in-class borrowing services, lenders are under pressure to reduce time-to-offer by as much as possible. And by using automated risk scoring and credit policies to accelerate decision making, some digital lenders even offer instant approval. This highly accelerated process poses significant risks to lenders, who may find themselves experiencing an uptick in credit defaults.

It’s a widespread industry concern, with lenders aware of the need to provide fast credit approval while also contending with a rising rate of delinquencies that, per the 2024 Global Consumer Lending Confidence Report, is likely to get worse before it gets better.

Lender fraud

Due to an increased reliance on online platforms, a higher volume of transactions and a greater sophistication among fraudsters, the digital lending sector has seen a growth in fraud in recent years. Application fraud, loan stacking, identity theft and money laundering are just a few examples of financial crimes threatening lenders. Besides the massive reputational damage that lenders will suffer from being victim to these crimes, they’ll likely also have to pay out hefty sums in remediation, as well as potential regulatory and legal fines.

Regulatory woes

In response to rises in financial crime and advancing technologies, more and more regulations are being put in place that impact the digital lending sector. Anti-Money Laundering (AML), Politically Exposed People (PEP) rules such as Know Your Customer (KYC) and Data Privacy and Cybersecurity such as General Data Protection Regulation (GDPR) in Europe all need to be adhered to by digital lenders.

The penalties for falling foul of regulatory frameworks are severe. They include fines – in October 2020, British Airways was fined £20 million by the UK Information Commissioner’s Office (ICO) for a 2018 data breach affecting over 400,000 customers – and even prohibiting the continuation of activities. In October of last year, Austrian investment bank Euram was forced to shut down its operations due to failing to comply with AML regulations.

Safeguarding your organization against credit risk, lender fraud and regulatory challenges

Regulatory and cybercrime challenges facing digital lenders should by no means be taken lightly. As we’ve seen, the consequences of falling foul of either are catastrophic. To navigate these challenges while also providing the best service for their customers, financial institutions need to ensure that they’re ready to face the latest in cybersecurity threat, as well as regulatory compliance.

Balancing speed with precision

To mitigate credit risk while maintaining fast approvals, lenders should leverage advanced analytics and machine learning to gain deeper insights into borrower profiles. These tools assess creditworthiness using 360-degree data, such as financial, banking and identity.

Real-time fraud detection and dynamic credit policies ensure agile yet accurate decisions. Coupled with robust monitoring and post-loan analytics, these innovations help reduce defaults, improve portfolio health and maintain consumer trust – all while staying competitive in time-to-offer.

Enhancing fraud detection mechanisms

When it comes to sniffing out fraudulent activities, organizations can leverage advanced technologies such as artificial intelligence and machine learning to analyze large volumes of data and quickly detect patterns of suspicious activity. Identity verification technologies can also be used to ensure that only users can access their sensitive data and accounts. And robust KYC measures can help organizations to verify identities, track customer transactions and assess potential risks, before cyber criminals have the chance to do any damage.

Prioritizing data privacy

Vast amounts of personal data are part and parcel of providing a sophisticated digital borrowing solution in 2025. However, this large amount of data can pose significant security risks to financial institutions and their customers. Beyond meeting legal requirements like GDPR-mandated privacy policies, lenders should implement robust data retention and governance policies to manage personal data responsibly. This includes ensuring data is not leaked to third parties, using fine-grained access control to restrict sensitive data access, and adopting strict practices for data minimization and secure storage.

Staying ahead of the regulatory curve

Financial institutions need to be aware of the latest regulatory frameworks concerning the digital lending space, and to ensure they’re fully compliant. Often, this will mean working with a dedicated compliance team as well as RegTech solutions – tools to streamline regulatory compliance and reduce the burden of manual processes.

How SBS can help

The future of digital lending lies in balancing innovation with security. While the threats are significant, so are the opportunities for those who invest in robust technologies and practices.

At SBS, we specialize in helping financial institutions balance these priorities effectively, enabling them to stay ahead of threats while delivering exceptional customer experiences. Our solution SBP Risk Assessment is designed to help institutions navigate the challenges of credit risk, fraud prevention and regulatory compliance within their credit risk analysis journey. By working with our team, you’ll gain access to a solution and expertise to ensure a secure and compliant credit analysis process that positively impacts your digital lending ecosystem.

Contact a member of our team today and learn how we can help you achieve a safe and compliant lending solution that will strongly improve customer satisfaction.