The second presidency of Donald Trump began on January 20, 2025, marking a pivotal moment for the future of the US and global economies that will be heavily influenced by the president-elect’s ambitious America-first economic agenda. With Republicans holding a narrow majority in both the US House of Representatives and Senate, Trump is expected to rapidly implement his America-first economic agenda, including significant tax cuts, increased trade tariffs, regulatory deregulation and substantial changes in immigration policies.

Economists worldwide have warned that Trump’s economic plan is expected to have significant implications not only for the US economy but also for global economic dynamics, particularly in China and Europe. However, a new survey by global CEO advisory firm Teneo found that confidence in the global economy has soared since President Trump’s election victory on November 6. Up to 77% of CEOs and 86% of investors expect the global economy to improve in the first six months of 2025, the Teneo study found.

Here, we explore the potential impact that Trump’s policies could have on economies worldwide.

Impact on the US

Trump’s economic strategy focuses on boosting domestic growth through expansive fiscal policies, including major infrastructure investments and tax cuts. Notably, Trump has announced significant tariffs: 25% on imports from Mexico and Canada and an initial 10% increase for Chinese goods, which could rise to 60%.

Trump’s tariff policy is expected to initially drive US inflation higher due to increased consumer prices and a tightened labor market resulting from stricter immigration controls. The move is likely to lead to retaliatory moves from countries impacted by the policy, with many warning they will introduce their own tariffs against the US. With a strong jobs market and a current inflation rate of 2.75%, the US economy has recovered from the COVID pandemic faster than other developed nations, primarily due to outgoing President Joe Biden’s vision of growing the economy from the “middle out and the bottom up.”

The Peterson Institute for International Economics (PIIE) has warned that Trump’s policies to deport millions, introduce steeper tariffs, and erode the US Federal Reserve’s political independence could stoke inflation and harm the US economy. “These three policies combined would result in lower US national income, lower employment, and higher inflation than otherwise. In some cases, economic conditions recover over time, but in others, the damage continues through 2040,” PIIE says in an October report.

Meanwhile, the “Trump Effect” is unlikely to boost the technology sector, according to Natixis Corporate and Investment Banking’s Global Outlook 2025 report. “For the time being, the ‘Trump Effect’ is unlikely to give the tech sector any real impetus, especially as current equity valuations are much higher than in 2016, and a post-election change in interest rate outlook is not conducive to a further valuation boost,” the report said.

Global economic implications

The shift in US economic policies under Trump’s administration could significantly affect major global economies, particularly China and Europe. As the world’s second-biggest economy, China is expected to face considerable challenges due to the sharp hike in US tariffs on its exports. With the manufacturing sector comprising around 26% of its GDP, China is vulnerable to trade disruptions and a weaker yuan.

The tariffs could also slow China’s 5% growth target to 4% as they will weaken exports and investment in the first quarter of 2025, S&P Global said in its Economic Outlook Q1 2025 report. “Maximum US tariffs on Chinese imports could significantly damage that economy. And, like before, China is almost sure to retaliate,” S&P said.

This could lead to China potentially depreciating the yuan to gain a competitive advantage to maintain export competitiveness, as well as introducing further fiscal and monetary measures to boost the economy. “China will also seek alternative markets to export its surpluses, to begin with Europe, as its main trading partner, which will likely respond to Chinese imports with tariffs. Chain reactions are expected,” Natixis said in its report.

Europe, meanwhile, will find itself in a delicate position amid trade tensions between the US and China. The Eurozone economy has been nearly stagnant since 2023, facing both cyclical and structural challenges. While lower inflation and interest rates are expected to boost consumer confidence and corporate investment in 2025, potential US tariffs on European goods, particularly in the automotive sector, will pose significant risks. Trump also warned the EU in December that it faced increased export tariffs if member countries did not increase their oil and gas purchases from the US, igniting fears of a trade war. According to a report by ING, the US emerged as the leading destination for European Union exports in 2023, accounting for 19.7% of the EU’s total exports outside the 27-member bloc.

Notably, the US relies on the EU for 32 strategically important import products, mainly in the chemical and pharmaceutical sectors, ING said. “This dependency balance favors the EU and will give it some leverage in negotiations with the incoming Trump administration,” it added.

Energy transition and climate policies

Despite Trump’s pro-hydrocarbon stance and intent to once again withdraw from the Paris Climate Accord, the global energy transition remains strong, with investments in renewable energy continuing to outpace that of fossil fuels. Europe and China are advancing in electrification and renewable energy adoption, while the US may see a slowdown in federal support for green initiatives, potentially affecting global efforts to combat climate change.

A well-known climate skeptic, Trump’s promise to “drill, baby, drill” to lower oil and gas prices has received a lukewarm sector response despite statistical evidence that the US has produced more crude oil than any country in the past six years. Globally, the energy transition remains an impressive underlying dynamic: For every dollar invested in oil, gas and coal, US$2 is invested in renewable energy, according to the Natixis report. Natixis added that in China, for example, 50% of new car registrations in 2025 will be electric, while stricter CO2 regulations and more affordable electric vehicles are expected to boost EV sales in Europe.

“In the US, the Trump-Musk duo is poised to initiate a clear slowdown, potentially exacerbated by the elimination of cash incentives for purchasing electric cars. The topic of autonomous vehicles could resurface as a strategy for Musk’s Tesla to position itself for future growth,” the report noted. However, Natixis believes that Trump’s impact on oil is likely overstated as prices are more influenced by OPEC’s management of weakening fundamentals.

Impact on government debt and fiscal sustainability

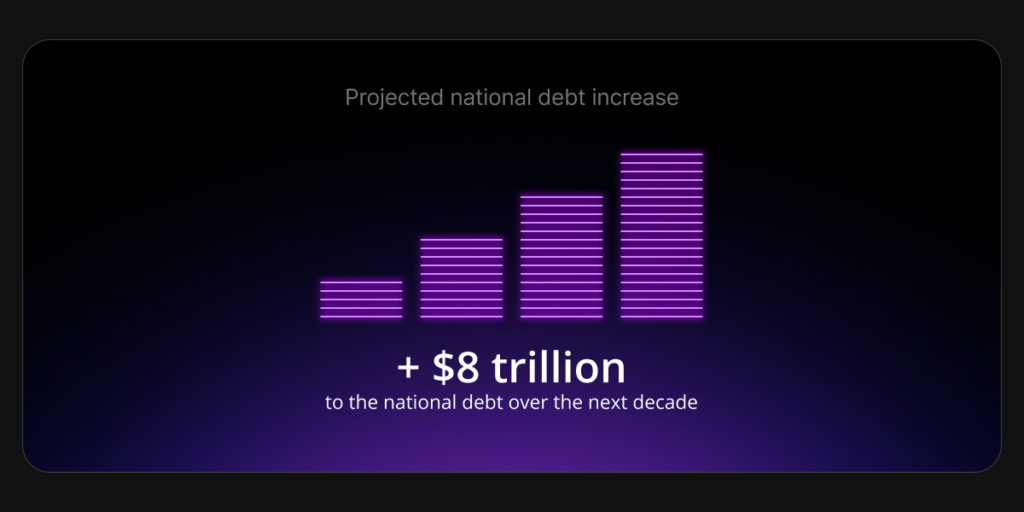

While Trump’s tax cuts, tariffs, and increased government spending are designed to spur growth, they raise concerns about the sustainability of US government debt. The non-partisan Committee for a Responsible Federal Budget estimates that Trump’s tax and spending plans could add approximately $8 trillion to the national debt over the next decade, pushing debt levels to unsustainable heights, according to a report by ICG.

It adds that markets have so far given the administration the benefit of the doubt, but this could change if credible fiscal plans are not presented. “With the fiscal deficit estimated at 7.6% of GDP and general government debt at 122% of GDP, there is little room for error,” ICG said in the report.

The global economic outlook for 2025 will be characterized by significant divergence driven by US policies under Trump. While the US may experience short-term growth, the ripple effects of protectionist measures and fiscal expansion are expected to pose challenges for other economies – and inflationary pressures, debt sustainability concerns and geopolitical tensions will add layers of complexity. Going forward, adaptability and strategic planning will be crucial for policymakers and investors. Monitoring policy developments, understanding their implications, and adjusting strategies accordingly will be essential for navigating the uncertain economic landscape of 2025.

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.