Transform your bank on your terms, at your speed

Re-invent your bank to ensure security, resiliency and success for decades to come. Our modular, cloud banking platform enables financial institutions to grow at their own pace, while providing exceptional digital-native customer experiences to anyone, anytime, anywhere.

Proven experience transforming banks across EMEA

SBS Banking Platform is a next-gen digital banking solution, transforming financial institutions across Europe, the Middle East, and Africa. From digital to open banking, deposits, payments, lending, and compliance, it helps retail banks, corporate banks, neobanks, and microfinance institutions, whether global or local, stay ahead of the curve.

Banks

From global banks to local lenders, we serve all entities, empowering them with innovative solutions to meet evolving customer needs.

Top EMEA banks

We are a trusted partner for the leading retail banks. Our solutions ensure they stay competitive and agile in a rapidly evolving market.

Percent of payments

Nearly half of France's instant payments are processed through our platform. We process 1.5 million transactions daily worldwide, and serve 30 million end users.

Percent

We support 1/5 of UK mortgages. These banks and building societies manage £16bn in savings and £265bn in mortgage portfolios.

Benefits

Grow your business with future-ready, modern banking solutions

Trusted by the industry's foremost analyst firms

Recognized by leading research firms such as Gartner, Forrester, Nelson Hall, and IBS, our product delivers transformative financial solutions. It empowers institutions to innovate, streamline operations, and stay ahead in today's quickly-evolving competitive landscape.

Confirmed as leaders

SBS Banking Platform is recognized as a leader in retail core banking, digital engagement, payments and corporate lending.

Recent achievements

Recent recognition by Omdia for digital banking, Chartis for regulatory reporting, and Nelson Hall for Cloud, SaaS & BpaaS, showcase our growth.

Partner excellence

Sister company Axway was named a leader in the 2024 Gartner Magic Quadrant for API Management.

Experts worldwide

With 3,400 financial experts across 80+ countries, we are committed to delivering cutting-edge solutions.

A holistic solution to drive innovation

Address all the domains of modern banking with SBS Banking Platform's front-to-back solution. Ensure digital-native experiences for your customers and bank employees alike thanks to mobile-first UI and intuitive design.

Core banking

Digital banking

Regulatory reporting

Digital lending

Next-gen core banking platform

Leverage the latest technology for core banking while ensuring sustainability. Our comprehensive processing platform includes deposits, cards, payments, regulatory reporting and lending — all delivered through a cost-effective SaaS-based model to support your bank’s growth sustainably.

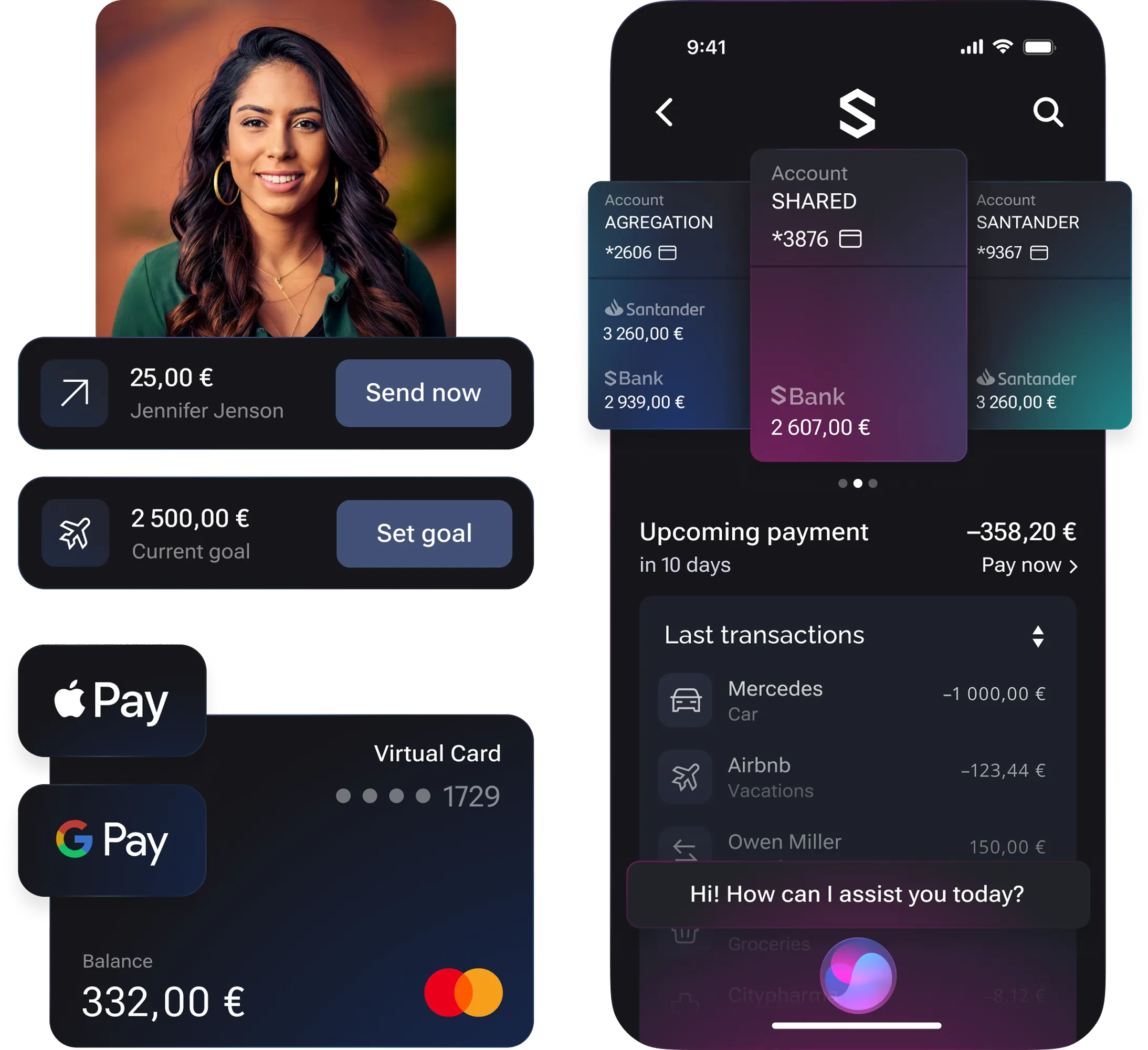

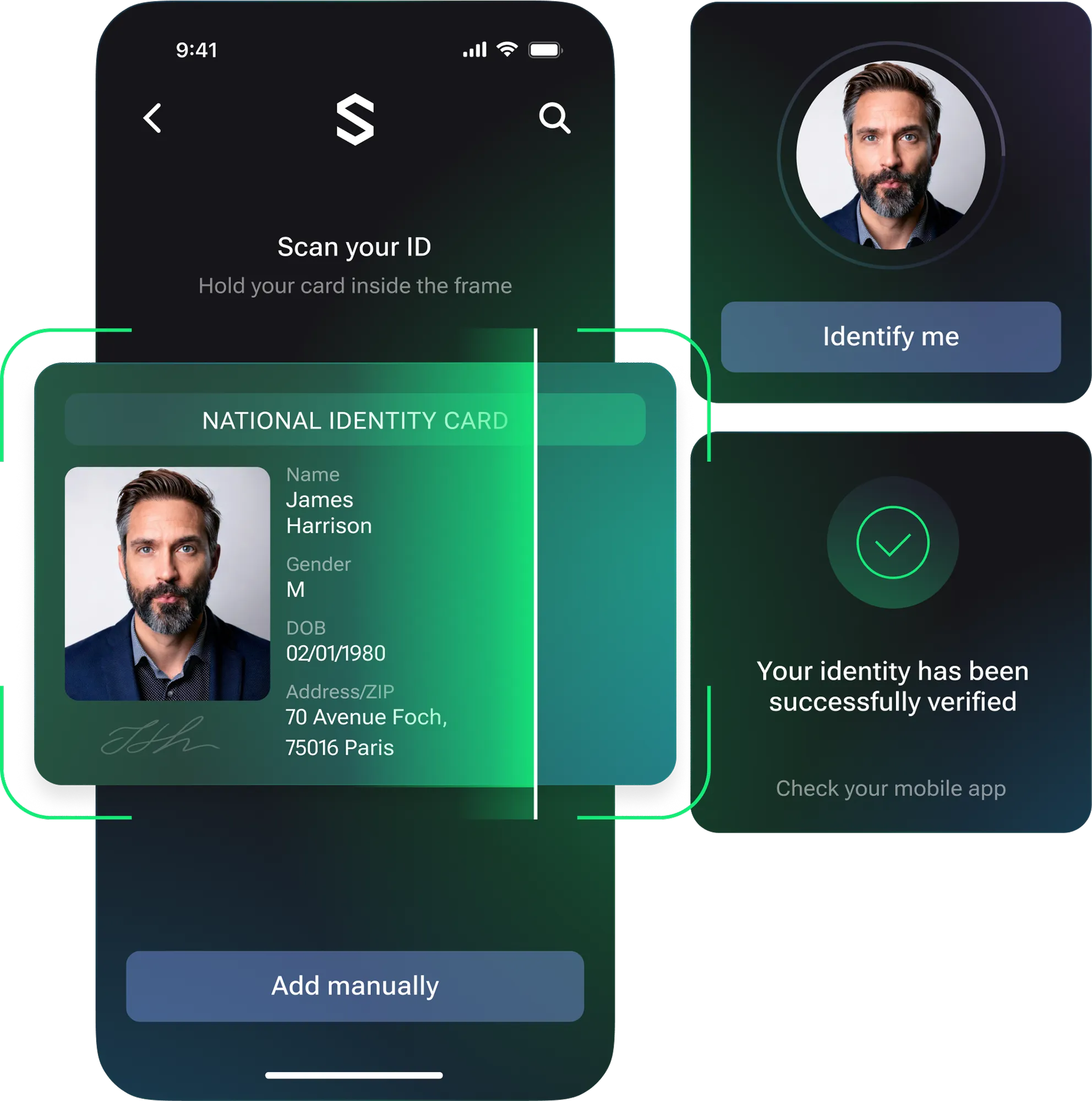

AI-powered, secure front-end

Unlock a cutting-edge, AI and data-driven banking platform that delivers secure and resilient experiences. Reduce costs, ensure compliance, and streamline transformation with open banking capabilities. Empower your financial institution to create delightful customer experiences while remaining competitive in an evolving market.

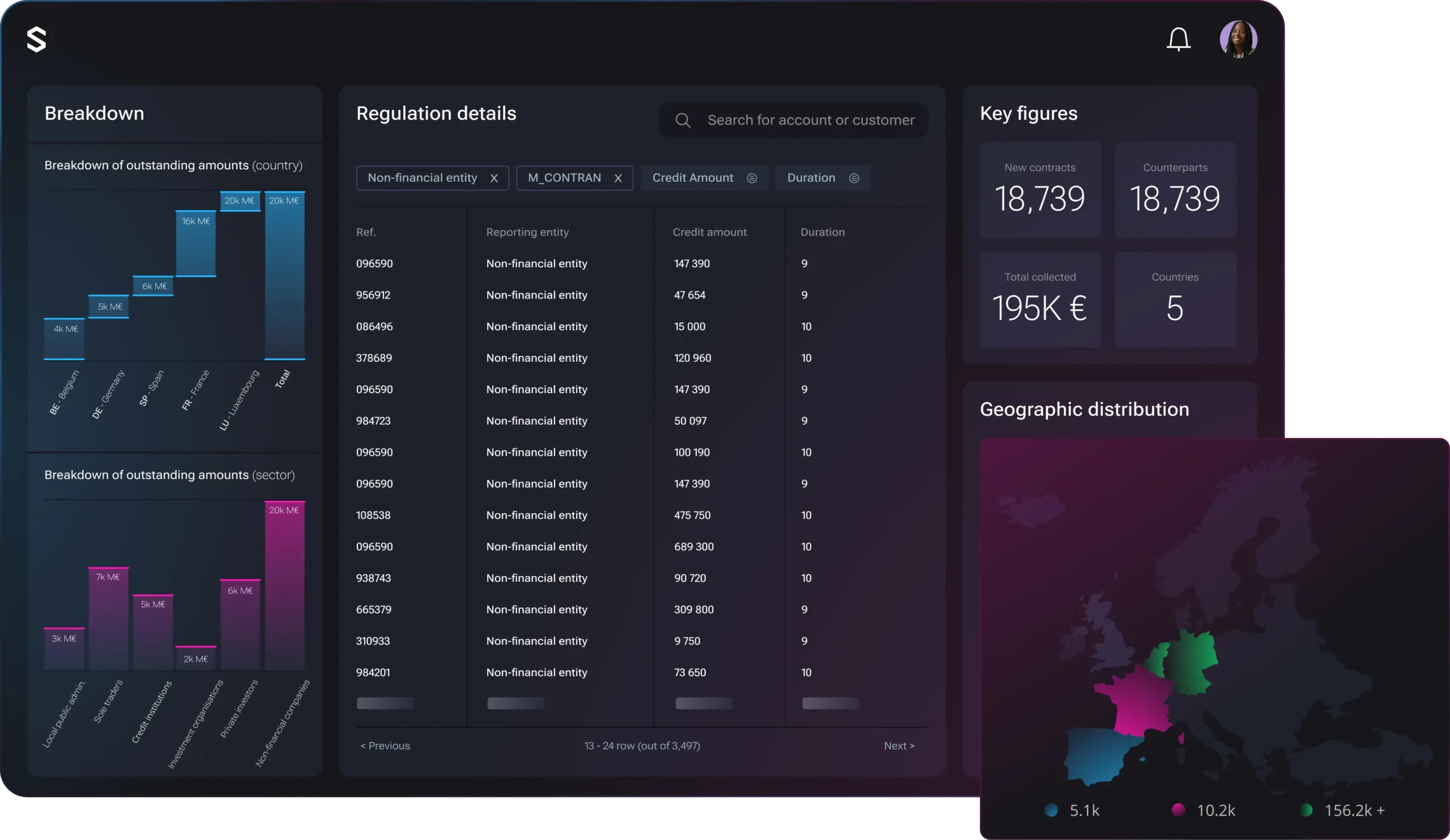

Unified regulatory reporting solution

Streamline data collection and enhance accuracy with a unified AI-powered regulatory reporting solution. Ensure 24/7 compliance, reduce operational costs, and deliver timely granular reports effortlessly to meet regulatory demands and improve overall reporting efficiency.

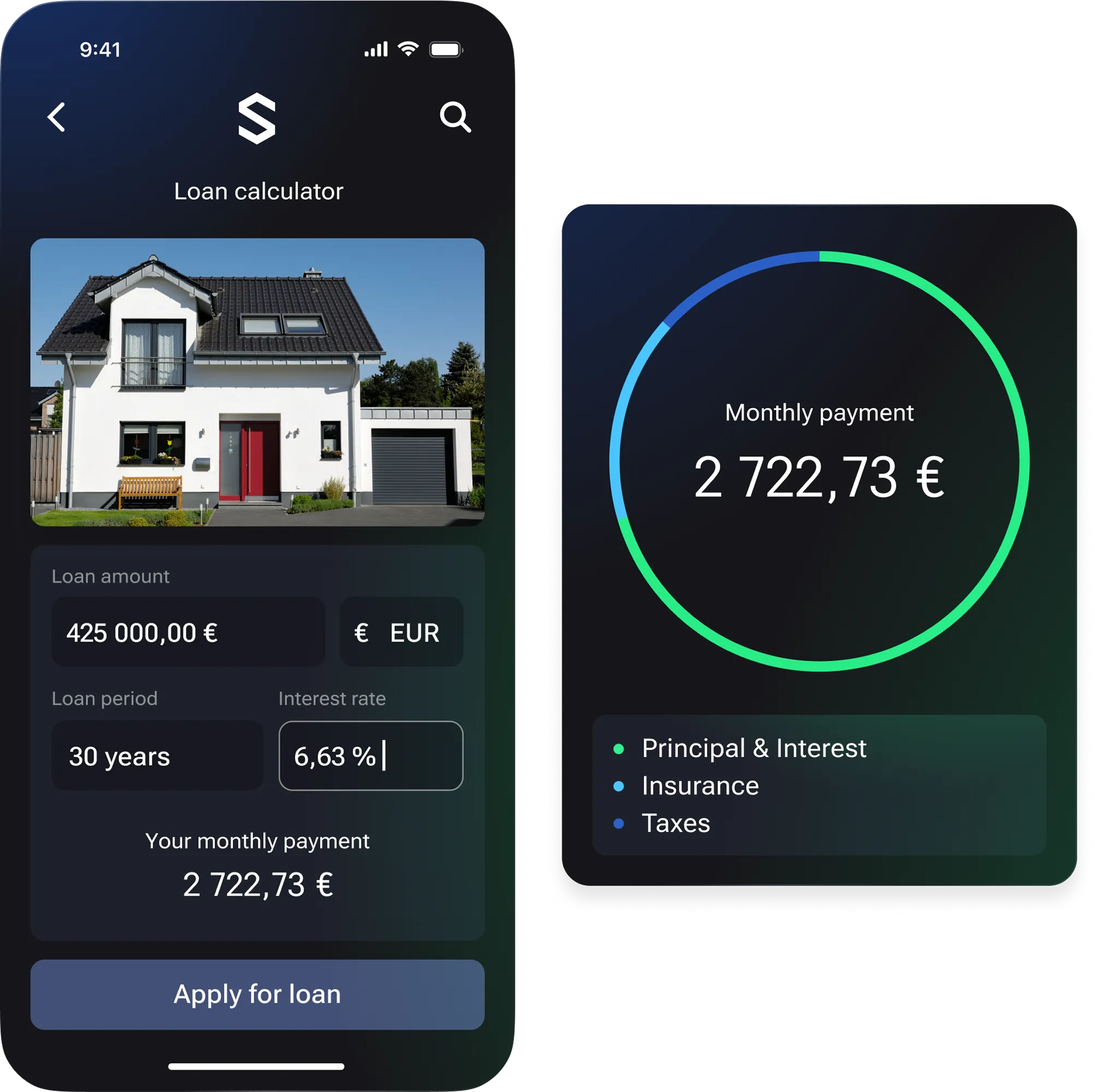

Agile lending and risk management

Manage credit and operational risk seamlessly for individuals and businesses alike. Automate processes, create agile workflows, and streamline decisions across the loan lifecycle — from origination to debt collection. Leverage data and AI for better decision-making with our robust banking software.

Technology

Leverage real-time actionable insights with Artificial Intelligence

The next-gen platform for all your banking needs, from processing to engagement

Explore